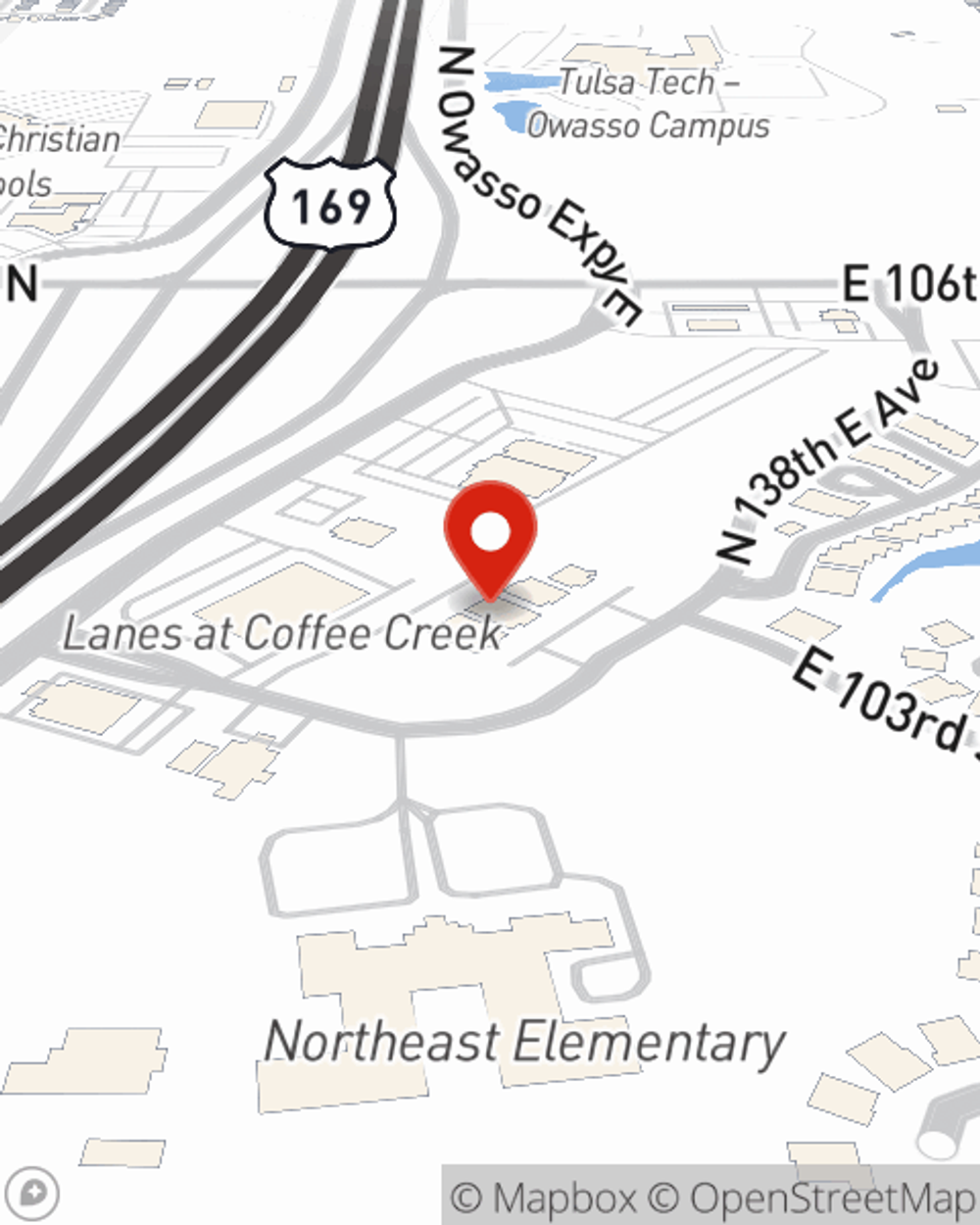

Life Insurance in and around Owasso

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

There's a common misconception that Life insurance is only needed when you get older, but even if you are young and just rented your first place, now could be the right time to start talking about Life insurance.

Insurance that helps life's moments move on

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

Life can be just as uncertain when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific time frame, State Farm can help you choose the right policy for you.

If you're a person, life insurance is for you. Agent Travis Primeaux would love to help you learn more about the variety of coverage options that State Farm offers and help you get a policy that's right for you and your family. Call or email Travis Primeaux's office to get started.

Have More Questions About Life Insurance?

Call Travis at (918) 371-8885 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Travis Primeaux

State Farm® Insurance AgentSimple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®